Real Yield for Additional Downside Protection

In addition to providing incentives for market participants to acquire EEFI during market downtrends, the Elastic Protocol will feature additional strategies that will diversify its offerings, provide additional yield opportunities to users and support EEFI's utility.

These strategies will generate fees that will be used to buy and burn EEFI during times when Ampleforth is not in positive rebase.

Examples of yield strategies/platforms that could potentially be added to the Elastic Protocol in the future, might include:

- GMX: Leverage platform that distributes 100% of fees

- Enso Finance: Social trading platform

- Aave: Premier lending platform with interest-bearing tokens

- Synthetix: Synthetic assets platform

- Liquity: New "Chicken Bonds" provide a novel way to generate optimized yield

- Ribbon Finance: Innovative options platform

Future Yield Strategies

Elastic Protocol will continue to pioneer an expanding ecosystem of yield strategies that will cater to DeFi users across a range of blockchains, communities, and interests. Each will help in generating sustainable yield and expanding the utility of EEFI as these strategies may interact with the Elastic Vault and its depositing economics. Here are some of the yield strategies we are looking into producing:

Immediate

- Uniswap LP Yield Strategy: An Olympus DAO yield strategy that takes advantage of OHM's Uniswap pairs

- Bond Protocol Bond Rewards Yield Strategy: An Olympus Bonds yield strategy that takes advantage of yield earned on OHM bonds. Bond Protocol markets for other token bonds will be explored over time.

Mid-Term

- Cooler Leverage Loan Vault: In light of Olympus implementing Cooler loans for $OHM this Vault would potentially allow for loan looping and provide enhanced stablecoin yield.

- Gearbox/ OHM Yield Strategy: would take advantage of yield opportunities that appeal to degens and decentralized leverage lovers.

- Aevo Options Vault: A leading options platform in crypto. This vault would allow depositors to take advantage of traditional options opportunities.

Long Term

- Olympus Real Yield RBS Vault: This strategy gives depositors a chance to participate in Olympus’s (growing) Real Yield econOHMy and earn stablecoin rewards from OHMs new RBS model.

- GMX/Vela Exchange Vault: Both platforms are leverage platforms that distribute 100% of fees to token holders. Both Vaults would be simple dollar cost average strategies

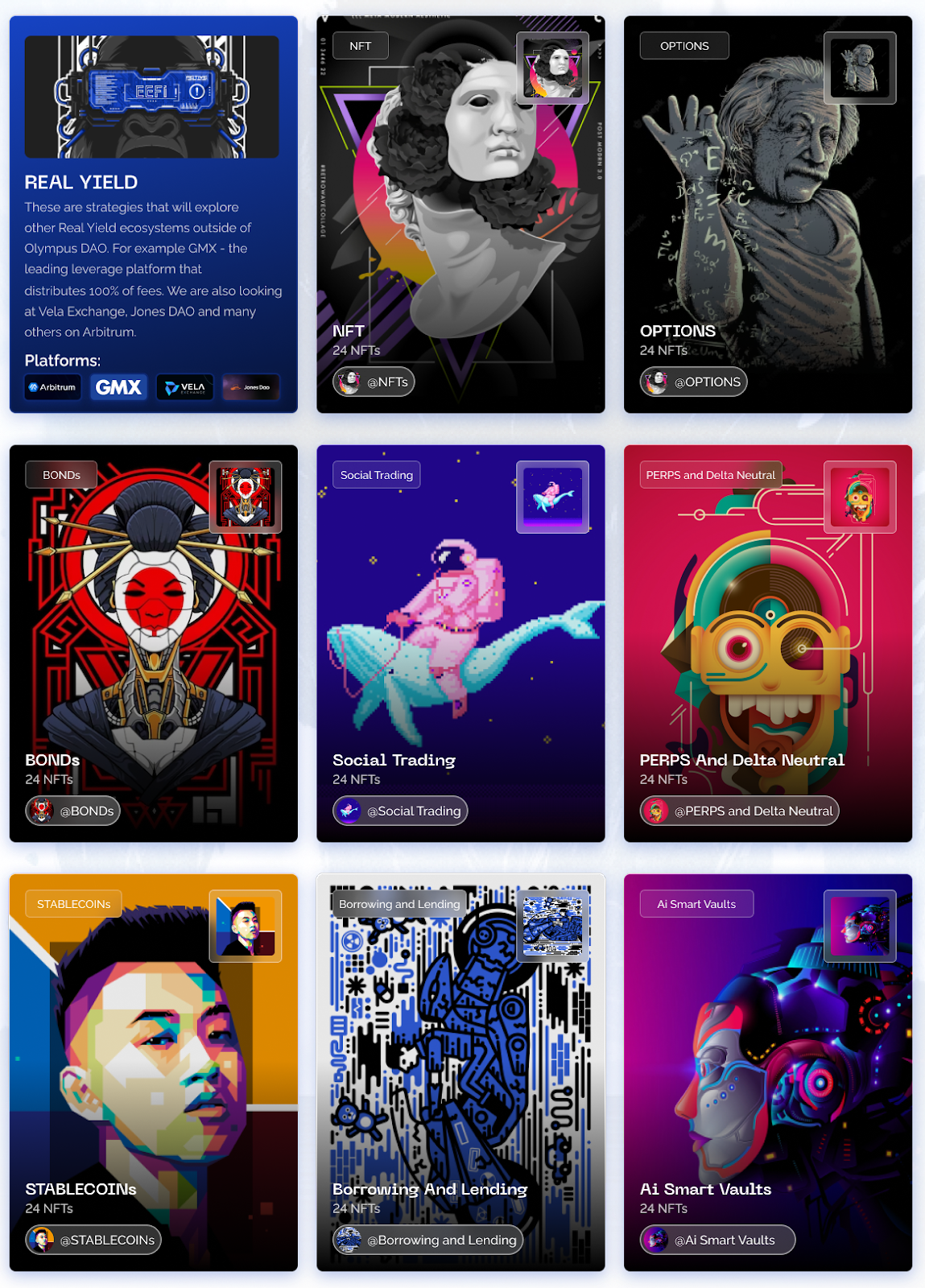

Aside from these Vault strategies, we have a number of yield strategy categories we are currently looking into including potential partner vaults that can be developed jointly. They can be viewed on our website in detail with descriptions and potential partners. All other yield strategies will need a vote to be approved for the Elastic Protocol.

See below for an overview of categories.

View larger version of this image

View larger version of this image

Roadmap

Given our plans for future yield strategies, we have produced a detailed roadmap of potential future activities.

Roadmap Disclaimer: This roadmap serves as an estimate of the long-term outlook and activities for the Elastic Protocol. The roadmap is not a guarantee or promise of future endeavors, achievements, or results. This roadmap could change significantly in the future, as new initiatives are introduced, and the protocol evolves. Planned activities may be removed from the roadmap, or current activities discontinued due to unforseen circumstances (legal, regulatory, compliance, etc.). This roadmap is a broad expression of potential areas of focus; timelines are estimated.