Understanding the Elastic Vault in the Context of AMPL's Price vs. Supply Dynamic

One of the key benefits of the Ampleforth (AMPL) token is its ability to (over long periods of time) remain relatively stable in price. This is a primary reason why Ampleforth's founding team, in a paper published about the durability of the Ampleforth network, asserted: "contracts [priced or] denominated in AMPL remain ... stable, even in the face of extreme market conditions."

However, while Ampleforth's price remains relatively stable, the supply of the token has not because "volatility of demand" is "transferred to token supply. This means that in periods of low demand, AMPL supply contracts. Conversely, AMPL supply increases during periods of high demand.

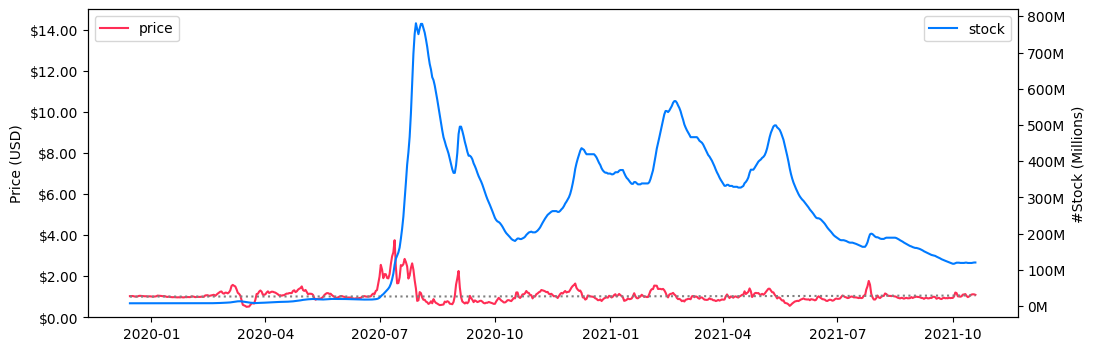

The relationship between AMPL's price (largely stable) and supply (volatile and declining) over a year-long period is illustrated in the image below. which was taken from this paper.

Ampleforth Stock Volatility Distribution

Ampleforth's unique characteristics have created a price vs. supply dynamic that impacts actors in the Ampleforth-driven crypto economy in a variety of ways. Certain actors are more sensitive to price, while others are heavily focused on overall AMPL supply, as outlined in the table below.

| Ampleforth Ecosystem Participant | Expectations | Focus: Price vs. Supply |

|---|---|---|

| AMPL Hodlers | Expectation: Higher AMPL supply over time AMPL Hodlers buy and hold the asset with the expectation that AMPL supply will increase over time. "If I buy 1,000 units of AMPL I expect, over a year that I will have at least 1,001 AMPL." | High Supply Focus If AMPL demand is inconsistent, price remains stable, but token supply declines, which can be a negative for holders. |

| AMPL Traders | Expectation: AMPL short-term volatility. AMPL traders are largely concerned about taking advantage of AMPL's volatility. "If I buy 1,000 units of AMPL I expect that I can sell at a higher price, or benefit from short-term supply increases." | High Price Focus Traders respond to short-term market moves and supply increases. In fact, traders have benefited greatly from AMPL price and supply volatility. The Ampleforth protocol relies on active trading to maintain long-term price stability. |

| AMPL Lenders | Expectation: Demand for AMPL. AMPL lenders are interested in constant demand for AMPL over time, which allows them to earn fees and be protected from negative rebases. "If I lend out 1,000 units of AMPL, I will get 1,000 units back plus benefit from interest payments." | High Price Focus Lenders earn more when demand for AMPL is elevated (due to high interest rates). |

| AMPL Borrowers | Expectation: AMPL short-term volatility. AMPL borrowers borrow the asset to take advantage of supply increases (during periods of elevated demand). "If I borrow 1,000 units of AMPL I expect that, due to the rebase, I will earn additional AMPL that I can sell for a profit." | High Supply Focus Borrowers earn when they borrow AMPL during positive rebases because they can sell the new supply and earn a profit after interest payments. Borrowers tend to avoid borrowing AMPL during negative rebases. |

AMPL's price vs. supply dynamic has led to different outcomes for ecosystem participants. For example:

- AMPL Hodlers have been negatively impacted (i.e., from a capital depreciation perspective) by declines in AMPL's token supply due to declining/uneven demand

- AMPL Lenders often do not earn a consistent income stream because of uneven demand for AMPL (high demand during positive rebases, low demand during neutral or negative rebases.)

The Elastic Protocol delivers benefits to all AMPL ecosystem participants, especially AMPL Hodlers and lenders who can use the vault (or benefit from its unique incentives) in a range of ways.

| Ampleforth Ecosystem Participant | Elastic Vault Benefits |

|---|---|

| AMPL Hodlers | Hedging Options: The Elastic Vault allows AMPL Hodlers to hedge against capital depreciation due to negative AMPL rebases. 1. AMPL Hodlers can deposit their AMPL into the Elastic Protocol and earn EEFI yield during negative rebases. 2. They can trade a portion of their AMPL for EEFI. This will provide them with exposure to AMPL (but not the negative rebase), and allow them to benefit from the reduction in EEFI supply that occurs during positive AMPL rebases. |

Elastic Vault users and EEFI holders can engage in various social coordination strategies to boost positive economic outcomes for themselves, the AMPL protocol and Elastic Vault users, as discussed in a previous section.