EEFI Tokenomics, Distribution and Liquidity Bootstrapping

As we now know, EEFI is the decentralized yield and rewards token of the protocol. It is a unique asset that produces amplified yield during market uptrends and protects from downside action during downtrends. It may also be the basis of a multichain effort as more strategies are added to the protocol. The basic breakdown of our tokenomics and the use of liquidity funding proceeds can be viewed below:

EEFI Tokenomics

170,000 estimated maximum supply.

- Liquidity Fundraiser (Seed and IBO) (~28%)

- Team | Advisors (21%)

- Partner Program (2%)

- Elastic Finance DAO Treasury (26%)

- Liquidity and Growth Asset Acqusition (Via Liquidity Boostrapping/Bonding Events)

- Development + Bounties

- Community Incentives Rewards + Referrals

- Marketing + Airdrops

- OG Community Contributors (%: TBD)

- This supply is locked for two years and vested for a minimum of two years after the Elastic Protocol launches.

Note: The full Treasury EEFI allocation was not pre-minted. Instead the protocol will mint smaller batches of EEFI on a regular basis to meet protocol needs such as liquidity bootstrapping, community token distribution and other purposes.

Full Vesting Schedule

| Allocation | EEFI Amount | Supply % | Vesting Schedule |

|---|---|---|---|

| Round 1 (IBO) - Seed Supporters | 10,000 | ~6% | 9 month Cliff (Lock Up); Tokens unlock over a 4 month period beginning in early July 2024 |

| Round 2 (IBO) - Strategic Supporters | 12,777 | ~7.5% | 5 month Cliff (Lock Up); Tokens unlock over a 3 month period beginning in mid-April 2024) |

| IBO Round 3 - Community Partners | 4700 | ~2.7% | 2 month Cliff (Lock Up) |

| Liquidity Bootstrapping Pool (LBP) - Community Supporters | 25,000 | ~15% | No cliffs or vesting (100% available at LBP conclusion); Portion of tokens allocated to LBP sourced from protocol Treasury |

| Founders | Team | 36,000 | ~21% | 1 year Cliff (Lock up); Tokens unlock over a 10 month period beginning in late September 2024; 10% of team allocation was distributed immediately |

| Treasury | 44,000 | ~26% | 20% was made available for liquidity and for other purposes such as liquidity bootstrapping, bonding activities and strategic purposes. Important: The full Treasury EEFI allocation was not pre-minted. Instead, it will be minted over time to meet ongoing Treasury / protocol needs. |

| Partners/Advisors | 2,500 | ~1.5% | 1 year Cliff (Lock up); Tokens unlock over a 2 year period |

| OG Contributors (Holders of EEFI v1) | Amount: TBD | %: TBD - Tokens have not been distributed | 2.5 Year Cliff, Tokens unlock over a 2 year period (note that the amount allocated to OG contributors is TBD and not guaranteed to be distributed) |

Notes:

- Round 1 pre-sale participants contributing above $2,500 received 2.5% of pre-sale EEFI tokens purchased immediately, the remainder was vested.

- Round 2 pre-sale participants contributing above $1,500 received 5% of pre-sale EEFI tokens purchased immediately, the remainder was vested.

- Round 1 and 2 participants holding bonus pre-sale EEFI received an airdrop of market EEFI tokens (corresponding to the amount of bonus pre-sale tokens held in their wallets) on April 12, 2024.

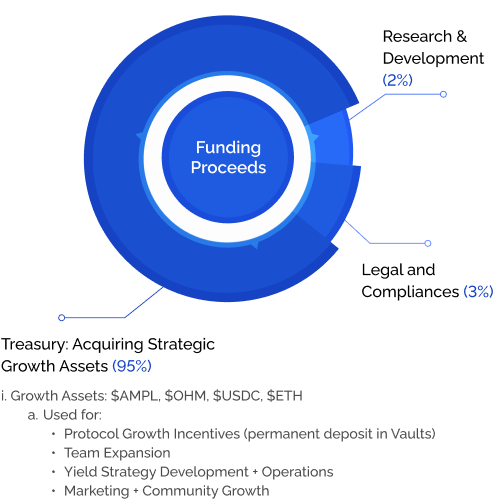

Use of Funds

Funds raised during liquidity and treasury bootstrapping efforts were allocated to:

- Purchase of AMPL for deposit into the Elastic Vault

- EEFI / OHM, EEFI / WETH, EEFI / SPOT, EEFI / WAMPL liquiidty

- Aquisition of strategic growth assets (fee-generating assets)

- Protocol operations and development

IBO/LBP (Initial Bond Offering/Liquidity Bootstrapping Pools)

Via Elastic Protocol-launched efforts and also in partnership with Bond Protocol | Fjord Foundry the protocol has conducted liquidity bootstrapping/bonding events where individuals can help bootstrap liquidity for our flagship strategies and the protocol’s native yield token EEFI. Individuals have provided stablecoins and WETH, to the treasury in exchange for discounted EEFI.

These bootstrapping events:

- Enable the permanent deposit of AMPL into the protocol's core elastic vault. This will help to sustain the protocol and the strategy’s growth into more tokens (long-term)

- Bolster liquidity for EEFI/OHM and other pairs on Uniswap

- Help to initialize the hyper social coordination aspect for community engagement (E,E)

- Provide support for Elastic Finance DAO operations as the protocol moves on to full decentralization and a multi-chain reality.

Additional Tokenomics Considerations

Pre-sale EEFI Exchange: During Rounds 1 - 3, users were provided with a pre-sale version of the EEFI token. A new version of EEFI (market EEFI) was launched for the liquidity bootstrapping pool. Participants in Rounds 1 - 3 are able to exchange/recieve pre-sale EEFI for market EEFI via:

- Pre-Sale Participants Airdrop: Holders who received bonus pre-sale tokens during Rounds 1 - 2 received airdropped market EEFI

- Exchange: Round 1 - 2 individuals will be able to claim and mint market EEFI as their tokens are unlocked during the vesting period

- Community Partner Airdrop: Community partners taking part in Round 3 received market EEFI via an airdrop

Regular Treasury EEFI Minting: The Treasury allocation of ~44,000 EEFI was not minted immediately. Instead smaller EEFI mints occur regularly in order to meet protocol and Treasury needs. A sample Treasury mint transaction is here.

The Importance of Protocol-Owned Liquidity: During the alpha testing phase of the core Elastic Vault, we recognized the importance of Protocol Owned Liquidity. Optimal vault operations require sufficient EEFI/OHM liquidity, which will be provided, in part, by the Elastic Protocol DAO (this is a primary reason we are engaging in liquidity bootstrapping efforts). This will ensure that vault users are confident in participating in automated protocol-driven operations, and will bolster the long-term health of the protocol.

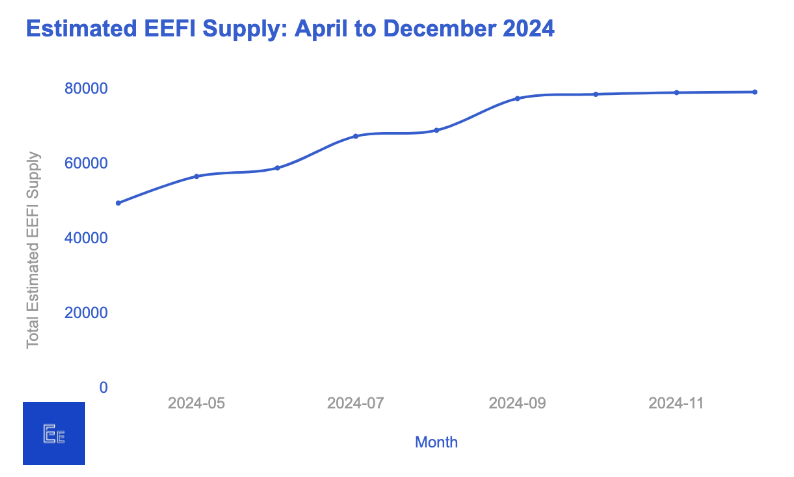

Estimated EEFI Supply 2024

This estimated supply chart (above) accounts for total EEFI supply increases generated via by EEFI mints from the following sources/activities:

- Vesting: Individuals claiming unlocked vesting pre-sale EEFI tokens can mint market EEFI on a 1:1 basis. On the cliff (token unlock) date, XX% of pre-sale tokens are available immediately for exchange to market EEFI. The remainder are unlocked daily until the vesting period close date.

- Treasury Mints: The EEFI protocol Treasury periodically mints tokens from its ~44k EEFI allocation for bonding, liquidity and other strategic purposes.

- Team Unlocks: EEFI protocol team member pre-sale tokens begin to unlock in September 2024. The chart shows an estimate of how many of these tokens will be converted to market EEFI during 2024.

Important: This estimated supply chart does not include EEFI that will be minted via the Elastic Vault. EEFI is minted by the vault during negative and neutral AMPL rebases. The amount minted depends on how much AMPL is in the vault. The Elastic Protocol Treasury may be the largest Elastic Vault depositor. As a result the majority of EEFI minted by the Elastic Vault will not enter circulation, but will be reflected in EEFI’s total supply.

Community Dashboard: Additional information about EEFI supply can be found on this community-developed Dune dashboard