EEFI Bonds

In 2021, Olympus DAO introduced a unique treasury building strategy called bonding. Originally designed to help build protocol-owned liquidity for Olympus, bonding is regularly being used by a variety of protocols to help them acquire different assets at at scale and with an attractive risk-reward profile for bonders.

With bonding, the Elastic Protocol Treasury offers EEFI -- at a discount to current market prices -- to community members. Key benefits of bonding include:

For Bond Buyers:

- Receive discounted EEFI. The tradeoff is that EEFI purchased via bonding will have a vesting (lockup) period of anywhere between 7 to 20 days

- Avoid fees associated with purchasing EEFI on DEXs such as Uniswap

- No price slippage on purchases, meaning that bond buyers can purchase EEFI at a discount without worrying about price impact, front-running or MEV

- Help strengthen the Elastic Protocol by contributing to increased EEFI liquidity and the protocol's ability to acquire growth assets; fees from growth assets will be used to buy and burn EEFI

For the Elastic Protocol:

- Assets acquired with bond proceeds will help diversify the Elastic Protocol Treasury

- Fees from growth assets will be used in automated EEFI buying and burning operations

EEFI Bond Basics

Where to Bond EEFI

Bond markets are available via the Elastic Protocol app. EEFI bond market smart contracts were developed by our partner Bond Protocol, which was founded by Olympus DAO alumni.

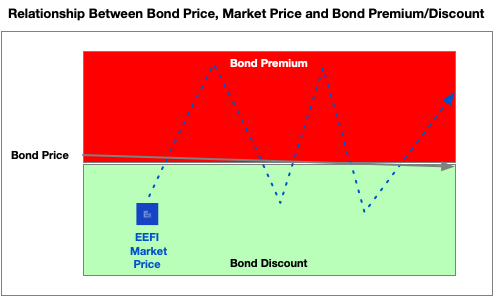

Market EEFI vs Bond Price

Bond markets operate as reverse dutch auctions. This means that bond prices decline over time -- anywhere from 1% to 1.5% per hour. Bond markets also have a price floor: about 30% - 40% from the bond starting price.

As shown in the image above, EEFI bond prices steadily decline (in a pre-determined fashion) over time. However, the market price of EEFI is more volatile. The difference between EEFI market and bond prices creates opportunities for bond buyers.

It's All About the Discount

EEFI's spot price will fluctuate above and below the EEFI bond price. When market price is above the bond price, this represents a bond premium (shown in red). When bonds are at a premium, individuals should not purchase EEFI bonds.

When bond price is below the market price, this represents a bond discount (shown in green). Bond discounts provide individuals with an opportunity to purchase EEFI bonds at a lower price versus the market. When a bond discount is present, individuals should buy EEFI bonds.

Bond Vesting Period

In exchange for discounted EEFI, bond buyers will not have immediate access to their EEFI. Instead, bonded EEFI is locked for a period of 7 to 20 days post-purchase. Bond holders will be able to claim their EEFI at bond maturity.

Why would bond buyers purchase discounted EEFI and be willing to wait for their EEFI to unlock?

- They may be hoping that by the time their EEFI are unlocked the token has increased in value

- Have confidence the protocol — via its automated fee generation and buy and burn activities — is setting EEFI up for long-term potential value appreciation

How Bond Proceeds Will Be Used: Growth Assets and Liquidity

Bonding allows the protocol to diversify EEFI's backing and how it is bought back and burned. Bond proceeds will be used to accelerate the way the protocol burns EEFI by diversifying into high-quality growth assets. Instead of relying on Vaults (such as the Elastic Vault and sub-vaults) alone to buy and burn EEFI, growth asset fee income will be used for this purpose.

Growth assets are any asset that produces yield or revenue, e.g.:

- Revenue Assets

- $GMX $HMX

- Yield-Bearing Assets

- $USDC $sDAI $USDe $LSTs $LRTs

- Real Yield Bearing Assets

- $PENDLE

- Rebase-Bearing Assets

- $AMPL $OHM

- LP Assets

- Various pools with well-established assets

Yields generated by these assets will be used to continuously buy and burn EEFI.

Also, bond proceeds will be used to strengthen and thicken EEFI liquidity on key pairs, including EEFI / WETH.

Growth Asset Strategy Example

For instance, if the Elastic Protocol via bonding were to acquire $35 million worth of $sDAI at today’s low sDAI APY rate (12%), approximately $13K per day would be used to buy and burn EEFI.

If the same sDAI yielded a 20% rate that would be $21K per day used to buy and burn EEFI. At 60%, an estimated $62K per day would be going to buy and burn EEFI.

This is also on the lower end of “safe yields” in the space—there many established growth assets that yield anywhere from 20% to 70% APY.

Review Medium Post For More Information About How to Participate in EEFI Bond Markets

We have developed a Medium post with information detailing how community members can participate in bond markets using the Elastic Finance app.